Bitcoin has been highly regarded by investors and the financial industry since its inception in 2009. As a digital currency, it not only changes the traditional financial system, but also presents enormous opportunities for many investors. However, the price volatility of Bitcoin is extremely high, and how to seize investment opportunities in such a market has become a topic of concern for many people. This article will delve into the logic behind the price of Bitcoin, analyze the reasons for price fluctuations, and provide practical advice for investors to help them find opportunities for success in a market full of uncertainty.

The price fluctuation of Bitcoin is one of its biggest characteristics

- Firstly, the supply and demand relationship in the Bitcoin market is very direct. When market demand suddenly increases, prices will rise rapidly; When demand decreases, prices will sharply drop. Due to the limited total quantity of Bitcoin (21 million coins), which is different from traditional fiat currencies, Bitcoin has inherent scarcity.

- Secondly, the Bitcoin market lacks regulatory agencies like traditional financial markets. Although some countries around the world are gradually taking regulatory measures, due to its decentralized nature, the price of the Bitcoin market relies more on market sentiment and speculative behavior, and investor sentiment fluctuations can directly affect the price. A large amount of news, policy changes, and even celebrity comments can have a significant impact on the market.

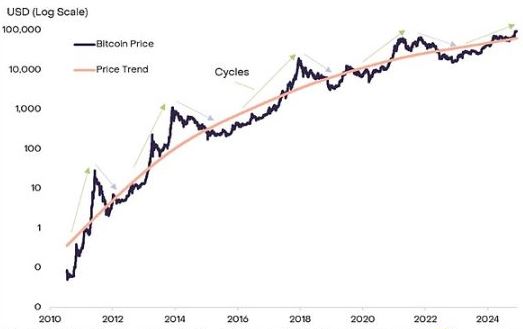

The price of Bitcoin has experienced several significant fluctuations in its history

For example, at the end of 2017, the price of Bitcoin briefly broke through the $20000 mark, but then fell sharply due to market overheating and investor panic. Afterwards, despite the overall upward trend in the market, the volatility remained significant.

According to historical data analysis, the price of Bitcoin exhibits cyclical fluctuations, usually entering a period of adjustment after experiencing rapid increases, and this volatility behavior is extremely evident in the short term. However, in the long run, the price of Bitcoin is showing an overall upward trend. In 2020 and 2021, the price of Bitcoin once again broke new highs, becoming the focus of global investors' attention.

Through these historical trends, it can be seen that the price of Bitcoin is influenced by various factors such as market sentiment, government policies, and the global economic situation. Investors need to have a keen market sense and patience in order to benefit from it.

The price of Bitcoin is not only determined by supply and demand, but also by many other factors that are driving its price up or down.

1. Macroeconomic environment: The uncertainty of the global economy, especially inflation and currency depreciation, will prompt investors to transfer funds to digital assets such as Bitcoin to hedge risks. Especially in the context of the depreciation of legal tender, the attribute of Bitcoin as "digital gold" has become increasingly prominent.

2. Technological Innovation and Blockchain Development: The blockchain technology behind Bitcoin is constantly evolving, providing possibilities for its future application scenarios and value growth. For example, an increasing number of institutional investors are accepting Bitcoin, and payment platforms such as PayPal are also supporting Bitcoin transactions, which has boosted the market demand for Bitcoin.

3. Government Policies and Regulation: Changes in policies by governments around the world have a significant impact on the price of Bitcoin. For example, the Chinese government closed the Bitcoin trading platform in 2017, which led to significant fluctuations in bitcoin price. Some countries, such as the United States and Japan, have gradually introduced friendly regulatory policies to promote the legalization process of Bitcoin.

4. Market sentiment and news dissemination: The Bitcoin market is highly sensitive to news. Investors' emotions are often the direct factor driving price fluctuations. For example, when a large enterprise announces that it will purchase Bitcoin as a reserve asset, the market will have a positive reaction and the price will rise accordingly.

Despite the huge price fluctuations of Bitcoin, it also provides opportunities for investors. To earn profits in this market, investors need to have a certain level of market insight and strategy.

1. Regularly review market trends: Maintain attention to Bitcoin market news, especially major news events that may affect market trends, such as government policies, global economic data, technological advancements, etc.

2. Combining long-term holding with short-term trading: Many successful Bitcoin investors often adopt a "long-term holding" strategy, especially by buying in large quantities during low prices and waiting for the market to recover. However, as the market matures, short-term trading has also become a way to profit, seizing short-term opportunities in price fluctuations through precise technical analysis and market forecasting.

3. Diversification and Risk Control: The Bitcoin market is full of uncertainty, so investors should avoid investing all their funds in Bitcoin. Diversifying investments into other digital assets or traditional financial assets can effectively reduce risks.

4. Technical Analysis and Trend Tracking: Familiarity with technical analysis is a powerful tool to help investors capture Bitcoin price fluctuations. By analyzing market charts, trading volume, trend lines, and other data, the price trend of Bitcoin can be predicted.

Although Bitcoin has enormous potential as an investment tool, the risks involved cannot be ignored. Firstly, extreme market volatility may result in significant losses for investors, especially without sufficient research. Secondly, due to the decentralized nature of Bitcoin and the lack of regulatory protection, investors may face security issues such as hacker attacks and exchange bankruptcies.

In addition, due to the high dependence of Bitcoin price on market sentiment, investors are prone to chasing after market highs and panic selling during market lows, resulting in losses. It is very important to maintain rationality and risk management in order to profit from Bitcoin investment.

The investment opportunities for Bitcoin are not without barriers, but with in-depth analysis of the market and reasonable investment strategies, investors can still profit from it. As the global acceptance of Bitcoin and other cryptocurrencies gradually increases, their potential value as digital assets may continue to grow in the future. While seizing investment opportunities, investors should also be vigilant about risks and maintain a cautious attitude in order to steadily move forward in this uncertain market.

Tips on SEO and Online Business

Previous Articles